Among older Americans, divorce and widowhood are at an all-time high, leading to new partnerships.…

A Brief Overview of Irrevocable and Revocable Trusts

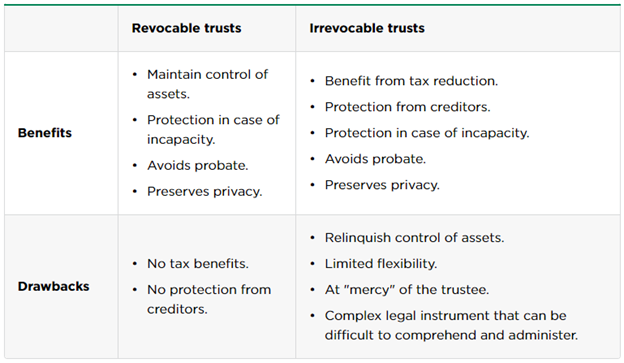

It is common to use revocable and irrevocable trusts in the estate planning process. Each has benefits and drawbacks depending on your goals. However, both trusts are legal arrangements to manage and distribute your property during your lifetime or afterward. The creator of a trust is a grantor who funds it by transferring their assets into the trust and naming beneficiaries.

Key Differences Between Revocable and Irrevocable Trusts

The key differences between these two trust types include:

· Control

A revocable trust allows the grantor to maintain control of the assets during their lifetime and make changes to the trust as needed as long as the grantor is mentally competent. In contrast, an irrevocable trust typically transfers control of the assets to the trust itself or a trustee. This prevents the grantor from making any changes to the trust once it is written and funded, with few exceptions.

· Tax Implications

A revocable trust is generally treated as part of the grantor’s estate for income tax purposes but does not reduce estate taxes. However, an irrevocable trust can be structured to reduce estate taxes by removing assets from the grantor’s estate.

· Creditor Protection

Assets in a revocable trust are generally not protected from the grantor’s creditors. In contrast, assets in an irrevocable trust can receive protection from creditors depending on the trust’s terms.

· Probate

A revocable trust can help avoid probate, the legal process after someone dies to transfer assets to their heirs. Assets held in a revocable trust are generally not subject to probate. An irrevocable trust can also help avoid probate; however, because the grantor gives up control of the trust’s assets, it may be more difficult to change the trust to accommodate changing circumstances.

· Privacy

A revocable trust can provide more privacy than a will since the terms of the trust don’t become part of the public record. An irrevocable trust can also provide privacy, but because it may involve transferring control of the assets to a trustee, it may be more difficult to keep the terms of the trust private.

Each trust type offers benefits and some drawbacks, and the choice between them will depend on the grantor’s specific estate planning circumstances and goals. An estate planning attorney can help determine which trust type is the most appropriate for a particular individual or family.

When to use a Revocable Trust

In some situations, a revocable trust may be the best option. There are eight circumstances when a revocable trust may be a good choice.

1. Avoiding Probate

One of the primary benefits of a revocable trust is that it can help you avoid probate. Assets in the trust can pass directly to your beneficiaries without the need to involve the court.

2. Incapacity Planning

If you become incapacitated and unable to manage your affairs, the trustee of your revocable trust can step in and manage the assets on your behalf. The trustee can properly manage your financial affairs and carry out your wishes.

3. Privacy

A revocable trust can provide more privacy than a will since the terms of the trust don’t become part of the public record. If you have concerns about your financial affairs becoming public knowledge, create a revocable trust.

4. Flexibility

Modifications or even fully revoking this trust type may occur during your lifetime. If circumstances change, you can make changes to your trust.

5. Blended Families

If you have a blended family, a revocable trust can be a good way to provide for your spouse and children from previous marriages. You can specify how you want your assets distributed and ensure you fulfill your wishes.

6. Special Needs Planning

If you have a child or other beneficiary with special needs, using a revocable trust can provide for their ongoing care and support you after death.

7. Real Estate Ownership in Multiple States

You can avoid ancillary probate in a state other than where you live.

8. Estate Value

This trust is a great choice if your estate is less than that federal estate tax exemption.

When to Use an Irrevocable Trust

In some situations, irrevocable trusts are the better option. There are seven specific circumstances when an irrevocable trust may be a good choice.

1. Estate Tax Planning

You can remove assets from your estate using an irrevocable trust, helping reduce or eliminate estate taxes. Once the assets transfer to the trust, they are no longer legally part of your estate for tax purposes.

2. Creditor Protection

Assets in an irrevocable trust receive protection from your creditors. This can be particularly important if you are in a profession or business that exposes you to liability.

3. Medicaid Planning

If you are concerned about the cost of long-term care and its impact on your estate, an irrevocable trust can transfer assets out of your name and into the trust. Doing so can help you qualify for Medicaid benefits if you need them.

4. Charitable Giving

An irrevocable trust can be a vehicle for charitable giving, allowing you to leave a legacy and support causes that are important to you.

5. Business Succession Planning

If you own a business, an irrevocable trust can transfer ownership to your heirs or to a trustee who can manage the business on behalf of your beneficiaries.

6. Comfort with Permanence

You must be comfortable giving up control of your asset after establishing the trust.

7. Estate Value

This trust is a great choice if your estate value is higher than the federal estate tax exemption, and you want to avoid estate taxes.

It’s important to note that an irrevocable trust isn’t as flexible as a revocable one since you can’t make changes after establishing and funding except in very limited circumstances. However, they can be a powerful tool for achieving specific estate planning goals.

How an Estate Planning Attorney can Help

An estate planning attorney can guide and assist you with revocable and irrevocable trusts to determine which will meet your goals, assets, and other factors. They may provide tax planning advice since trusts have complex tax implications and assets must be transferred efficiently.

Your estate planning attorney can draft the trust documents and ensure proper execution. If you already have a trust, they can review the documents, ensuring they still meet your needs and comply with changes in the law.

Contact our firm for ongoing support and advice, ensuring your trust meets your needs throughout your lifetime. Please contact our Nashua office at (603) 881-9161 or our Woburn office at 978-458-4566 and schedule a consultation to discuss your legal matters. We look forward to the opportunity to work with you.